AskTomCrowley.com

AskTomCrowley.Com

Wealth without Risk. Growth without Taxes. Security for Life.

Backed by IRS Code 7702 and 60+ years of experience.

Tom Crowley helps you grow wealth safely and leave a lasting legacy.

— Tom Crowley

Retire Smarter. Grow Tax-Free.

Leave a Legacy.

-Tom Crowley

Backed by IRS Code 7702 and 60+ years of experience.

Tom Crowley helps you grow wealth safely and leave a lasting legacy..

Lifetime tax-free income

Locked-in gains (never lose to market drops)

Flexible access after Year 1

Living & legacy benefits for loved ones

Schedule your free strategy call.

Schedule your free strategy call.

How the Crowley Wealth Strategy Works

(A Smarter, Safer Path to Tax-Free Growth)

✅ Step 1: Book Your Free Strategy Call

ASchedule a short conversation with Tom Crowley to discuss your goals, what you’re currently doing, and where you want your money to take you.

✅ Step 2: Receive Your Custom Wealth Blueprint

Within 48 hours, Tom will send you a personalized plan showing how to grow and protect wealth using proven, tax-advantaged principles — tailored to your lifestyle, business, and long-term goals.

✅ Step 3: Grow and Protect Your Wealth

Start building tax-free wealth while protecting your assets and family legacy — with Tom’s ongoing insight and guidance every step of the way.

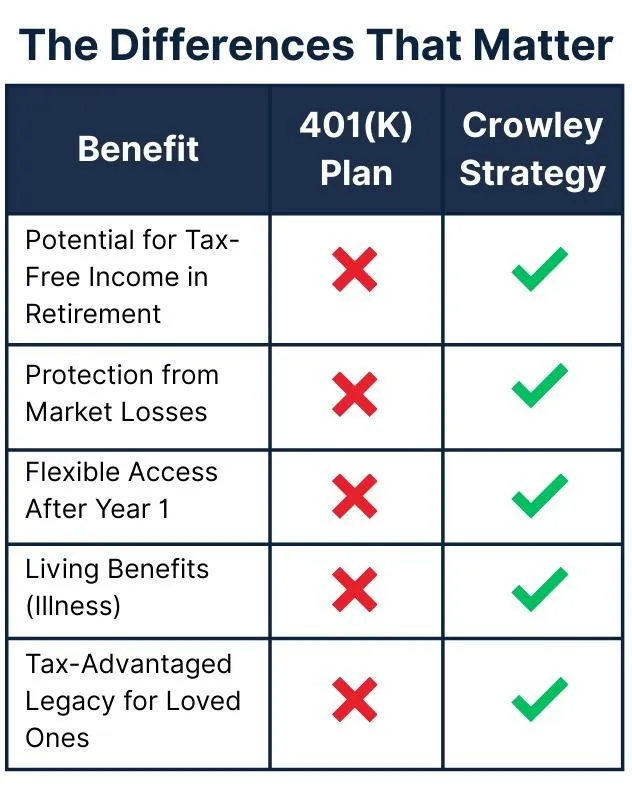

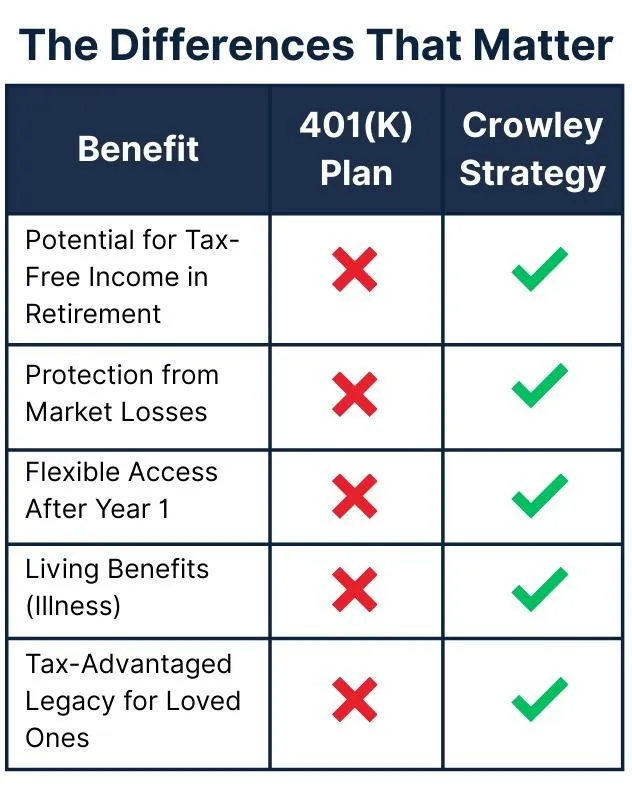

What Is the Crowley Wealth Strategy?

A proven, tax-advantaged plan built on IRS Code 7702.

Avoid market losses

Grow wealth tax-free

Access funds anytime

Leave a lasting legacy

It's how smart families build wealth without Wall Street risk.

IRS Code 7702: The Hidden Gem of Tax-Free Wealth

IRS Code 7702 is a little-known section of the tax code that allows your money to grow

— and come back to you — completely tax-free. It’s been used for decades by banks, corporations, and savvy individuals to achieve:

Tax-free accumulation of cash value

Tax-free access to funds through policy loans

Tax-free transfer of wealth to beneficiaries

This is a unique benefit of this financial instrument. Unlike retirement accounts that are taxed on the way out, a properly designed 7702 plan can provide tax-free income for life—and still leave a legacy.

“It’s like having your own private bank—liquid, protected, and tax-advantaged.”

IRS Code 7702: The Hidden Gem of

Tax-Free Wealth

IRS Code 7702 is a little-known section of the tax code that allows your money to grow

— and come back to you — completely tax-free. It’s been used for decades by banks, corporations, and savvy individuals to achieve:

Tax-free accumulation of cash value

Tax-free access to funds through policy loans

Tax-free transfer of wealth to beneficiaries

This is a unique benefit of this financial instrument. Unlike retirement accounts that are taxed on the way out, a properly designed 7702 plan can provide tax-free income for life—and still leave a legacy.

“It’s like having your own private bank—liquid, protected, and tax-advantaged.”

What Is the Crowley Wealth Strategy?

A proven, tax-advantaged plan built on

IRS Code 7702.

Avoid market losses

Grow wealth tax-free

Access funds anytime

Leave a lasting legacy

It’s how smart families build wealth without Wall Street risk.

Who Is This For?

Whether you’re planning for retirement, running a business, or just tired of watching taxes and market swings eat your savings — this strategy is for you.

It's designed for:

✅ Individuals and Families — who want tax-free growth, flexibility, and peace of mind.

✅ Business Owners and Professionals — who want to attract and retain employees while protecting their own wealth.

✅ Pre-Retirees and Retirees — who want income they can count on for life, without worrying about taxes or market crashes.

No matter your age or income level, the goal is the same:

Keep more of what you earn, grow it safely, and make sure it’s there when you need it most.

Who Is This For?

Whether you’re planning for retirement, running a business, or just tired of watching taxes and market swings eat your savings — this strategy is for you.

It's designed for:

✅ Individuals and Families — who want tax-free growth, flexibility, and peace of mind.

✅ Business Owners and Professionals — who want to attract and retain employees while protecting their own wealth.

✅ Pre-Retirees and Retirees — who want income they can count on for life, without worrying about taxes or market crashes.

No matter your age or income level, the goal is the same:

Keep more of what you earn, grow it safely, and make sure it’s there when you need it most.

How a Simple $250 Match Turned into

$2 Million Tax-Free

“No market losses. No taxes. Just smart, steady growth.”

A 35-year-old employee contributed $250/month. Her employer matched $250. Over her career (ages 35–64), that’s $180,000 total savings. At retirement, she receives over $2 million tax-free in lifetime income — plus a $260,000 legacy benefit for her family.

Reward Loyalty. Retain Talent.

Build Legacy.

Today’s top employees want more than a paycheck — they want peace of mind.

Tom’s employer benefit strategy helps companies attract and retain key talent by offering:

✅ A million-dollar, tax-free retirement path

✅ Employer-matching options

✅ Cash access during illness or emergencies

✅ Estate protection for employees’ families

How a Simple $250 Match Turned into $2 Million Tax-Free

No market losses. No taxes. Just smart, steady growth.

A 35-year-old employee contributed $250/month. Her employer matched $250. Over her career (ages 35–64), that’s $180,000 total savings. At retirement, she receives over $2 million tax-free in lifetime income — plus a $260,000 legacy benefit for her family.

Inspired by Timeless Financial Wisdom

Visionaries and innovators — from Walt Disney to the great entrepreneurial families of the world — used similar principles to protect and multiply their wealth. Now you can apply those same fundamentals to your own plan, simplified and modernized for today’s world.

Typical Long-Term Performance

10-Year Historical Average ≈ 13.4%

20-Year Historical Average ≈ 11.3%

(Results vary; these figures reflect independent historical market data used in modeling tax-advantaged strategies.)

Meet Tom Crowley:

81 Years Young and Still Going Strong

Tom has spent six decades building businesses and helping others protect their wealth through calm, clear financial strategies that work. He’s not a salesman — he’s a teacher. His mission: to help people grow wealth tax-free, live free, and leave a legacy that lasts.

Tom has spent six decades building businesses and helping others protect their wealth through calm, clear financial strategies that work. He’s not a salesman — he’s a teacher. His mission: to help people grow wealth tax-free, live free, and leave a legacy that lasts.

60+ Years in Business

Straightforward, No-Pressure Guidance

Families • Professionals • Business Owners

The Crowley Report:

A Private Invitation for Visionary Leaders

Written by Tom Crowley, this private briefing reveals:

✅ Why traditional retirement plans quietly fail families

✅ How modern strategies protect income and legacy

✅ Why forward-thinking leaders are adopting this now

Fill Out this Form

Testimonials

“Tom Crowley is kind, compassionate, and deeply knowledgeable — he puts your mind at ease. Thanks to his guidance, I now enjoy reliable, tax‑advantaged income for life, without the fear of market crashes.”

“Tom is incredibly knowledgeable when it comes to these strategies. The way he explains the Crowley strategy finally made everything make sense for me. I’ve learned so much from him, and it’s genuinely changed my life for the better. His guidance has given me clarity, confidence, and a whole new direction that I’m truly grateful for.”

Working with Tom was a great experience. I had been in a variable universal life policy for years and wasn’t sure if it was still the right fit for me. Tom took the time to clearly explain my options and guided me into an indexed universal life policy that makes much more sense for my situation. The process was quick, easy, and very well organized. Now I have a policy that protects me from market downturns while still giving me strong growth potential. I feel much more confident about my long‑term plan thanks to Tom’s guidance.

How the Crowley Wealth Strategy Works

(A Smarter, Safer Path to Tax-Free Growth)

✅ Step 1: Book Your Free Strategy Call

Schedule a short conversation with Tom Crowley to discuss your goals, what you’re currently doing, and where you want your money to take you.

✅ Step 2: Receive Your Custom Wealth Blueprint

Within 48 hours, Tom will send you a personalized plan showing how to grow and protect wealth using proven, tax-advantaged principles — tailored to your lifestyle, business, and long-term goals.

✅ Step 3: Grow and Protect Your Wealth

Start building tax-free wealth while protecting your assets and family legacy — with Tom’s ongoing insight and guidance every step of the way.

Reward Loyalty. Retain Talent.

Build Legacy.

Today’s top employees want more than a paycheck — they want peace of mind.

Tom’s employer benefit strategy helps companies attract and retain key talent by offering:

✅ A million-dollar, tax-free retirement path

✅ Employer-matching options

✅ Cash access during illness or emergencies

✅ Estate protection for employees’ families

Inspired by Timeless Financial Wisdom

Visionaries and innovators — from Walt Disney to the great entrepreneurial families of the world — used similar principles to protect and multiply their wealth. Now you can apply those same fundamentals to your own plan, simplified and modernized for today’s world.

Typical Long-Term Performance

10-Year Historical Average ≈ 13.4%

20-Year Historical Average ≈ 11.3%

(Results vary; these figures reflect independent historical market data used in modeling tax-advantaged strategies.)

Frequently Asked Questions

Q1: What exactly is this strategy?

It’s a structured, tax-advantaged financial approach that allows your money to grow and be accessed tax-free — often outperforming traditional retirement plans while reducing market exposure.

Q2: Is it safe?

Yes. Your principal is protected from market losses, and you maintain access to your money whenever you need it.

Q3: Who is it for?

Families seeking stable, long-term growth

Entrepreneurs and professionals planning for retirement

Grandparents or legacy-builders wanting to transfer wealth efficiently

Q4: What does it cost to get started?

Your first strategy session with Tom Crowley is completely free — no obligation, no pressure.

Q5: How do I know if it’s right for me?

Schedule your complimentary call and Tom will walk you through your personalized analysis to see if it fits your goals.

The Crowley Report: A Private Invitation for Visionary Leaders

Testimonials

“Tom Crowley is kind, compassionate, and deeply knowledgeable — he puts your mind at ease. Thanks to his guidance, I now enjoy reliable, tax‑advantaged income for life, without the fear of market crashes.”

“Tom is incredibly knowledgeable when it comes to these strategies. The way he explains the Crowley strategy finally made everything make sense for me. I’ve learned so much from him, and it’s genuinely changed my life for the better. His guidance has given me clarity, confidence, and a whole new direction that I’m truly grateful for.”

Working with Tom was a great experience. I had been in a variable universal life policy for years and wasn’t sure if it was still the right fit for me. Tom took the time to clearly explain my options and guided me into an indexed universal life policy that makes much more sense for my situation. The process was quick, easy, and very well organized. Now I have a policy that protects me from market downturns while still giving me strong growth potential. I feel much more confident about my long‑term plan thanks to Tom’s guidance.

Written by Tom Crowley, this private briefing reveals:

✅ Why traditional retirement plans quietly fail families

✅ How modern strategies protect income and legacy

✅ Why forward-thinking leaders are adopting this now

Fill Out This Form

Meet Tom Crowley — 81 Years Young and Still Going Strong

Tom has spent six decades building businesses and helping others protect their wealth through calm, clear financial strategies that work. He’s not a salesman — he’s a teacher. His mission: to help people grow wealth tax-free, live free, and leave a legacy that lasts.

60+ Years in Business

Straightforward, No-Pressure Guidance

Families • Professionals • Business Owners

Frequently Asked Questions

Q1: What exactly is this strategy?

A tax-advantaged approach under IRS Code 7702 to grow wealth safely while keeping access.

Q2: Is it safe?

Yes. Your principal is protected from market loss while still allowing growth.

Q2: Who is it for?

Professionals, business owners, and families planning for retirement or legacy.

Q4: Cost to start?

Your first call with Tom is free — no sales pitch, just clarity.

Q1: What exactly is this strategy?

A tax-advantaged approach under IRS Code 7702 to grow wealth safely while keeping access.

Q2: Is it safe?

Yes. Your principal is protected from market loss while still allowing growth.

Q3: Who is this for?

Professionals, business owners, and families planning for retirement or legacy.